what is a reverse mortgage

We'll walk you through this complex financial product and evaluate its advantages and disadvantages by addressing one of the most typical inquiries individuals have concerning reverse mortgages. As an instance in factor, when I requested a reverse home loan in 2017, I was notified that I was needed to set up a cash set-aside due to a federal (U.S) tax obligation lien. As I, however, did not have enough funds for the set-aside, nevertheless, the application was declined, and also I have actually subsequently been living listed below the poverty line and having a hard time for survival since. With fixed-income properties paying out nothing these days, reverse mortgages may be an useful method to money day-to-day living expenses. If you prepare to leave your house to beneficiaries, they'll need to comprehend their settlement options.

- Reverse home mortgages do not have to be paid off up until you offer your residence or you or your enduring companion die.

- What's even more, many reverse home loan terms need customers to stay on top of real estate tax, property owners insurance and upkeep costs to stay clear of default.

- In many cases, property owners need to offer the home to please the lending.

- If you need help, you should take into consideration alternatives like loan adjustment, which might enable you to extend your finance term or lower your rate of interest without having to re-finance.

- The quantity you can obtain differs extensively where you live, the kind of real estate you have, your age and also sex, as well as the quantity of your current debt.

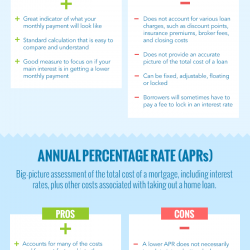

Some monetary organizers think about a reverse mortgage to be a good technique for making the most of possessions that you can delegate your beneficiaries. The thinking is that money you withdraw from some pension is strained as income. On the various other hand, the money you get from a reverse home mortgage is not taxed. So if you can survive reverse home mortgage earnings as well as preserve your retired life cost savings, you could wind up leaving even more money to your beneficiaries. If your retirement earnings is also low to cover all of your economic responsibilities, a reverse home mortgage can help you afford to stay in your residence by giving you with funds to pay your real estate tax and also upkeep expenditures. In contrast to a typical mortgage, reverse home loans are a growing financial debt that consumes the equity in your house.

Where To Obtain A Reverse Mortgage

The category of non-borrowing spouse, created in 2015, means the staying partner can continue to be in the house. Several variables must be in location for a reverse home mortgage to work. With a reverse home mortgage, you need to make sure you can manage your house for life, McClanahan claims. Discover financing provides with prices and also terms that fit your needs. It's a product made sure by the Federal Housing Management.

Residence Equity Conversion Home Mortgages Hecms

The amount you can borrow depends mainly on the age of the youngest customer and how much equity you have in the house. Present home mortgage rates and your other monetary how to get out of timeshare contract responsibilities, consisting of any kind of current home loan, More helpful hints are additionally aspects. They're a terrific suitable for some house owners, however a reverse home loan can leave making it through member of the family without equity, as well as sometimes no residence.

I am unsure I comprehend what you are stating below yet if you are asking me if I would suggest you to deed your residential or commercial property to somebody else in an initiative to acquire a finance, I would certainly inform you absolutely no. In the first place, this is mortgage fraudulence to position your home in another person's name simply to secure a lending and in the 2nd place, just how would you be certain nothing would certainly occur that you didn't lose your residential property? I would certainly encourage you to seek the suggestions of an attorney prior to you contemplated any plan which involved transferring title for the functions of obtaining financing.

If you have a question, others likely have the very same concern, as well. By sharing your inquiries and also our responses, we can assist others also. Our company believe by providing tools as well as education we can assist individuals optimize their funds to gain back control of their future. While our posts may include or feature choose companies, vendors, as well as products, our method to assembling such is equitable and honest.

Kathy sees her mommy struggling to pay for utilities, medicine, food and various other household costs on her decreased income. While Kathy assists as long as she can, she has her own family and job to manage. Most loan providers established extremely traditional loan-to-value limits based on the borrower's age and also the appraised market price of the home.

The loan to value ratio starts at 15% at age 60 prior to increasing in about 1% increments each year. Provide the residential or commercial property to the lending institution in an act instead of repossession. However there are scammer out there who maximize the distress of struggling home owners. See expert-recommended re-finance alternatives as well as customize them to fit your budget plan. If your home mortgage term is showing up for renewal, you'll need to discuss a new mortgage before the old one expires. Take a look at the adhering to chart, which shows the estimated market price of https://www.trustpilot.com/review/timesharecancellations.com Barry's residential property over the course of two decades as well as the rate of interest to equity proportion.

Ingen kommentarer endnu