home mortgage points calculator

Bank of America and/or its affiliates, as well as Khan Academy, presume no obligation for any type of loss or damage arising from one's dependence on the product given. Please additionally keep in mind that such product is not upgraded frequently which some of the info might not for that reason be current. Speak with your very own monetary expert and tax obligation consultant when choosing regarding your financial situation.

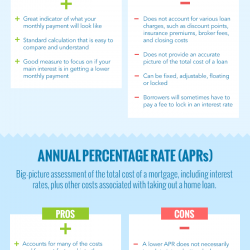

There are lots of financial institutions to choose from and also many sources– consisting of real estate agents, home loan brokers, and also the Internet– to help you look for the best deal for your circumstance. Source factors are typically preventable as well as negotiable so don't spend too much on them. Discount rate factors can save you a lot over the life of the finance, however only if you can pay for to purchase them without decreasing your down payment below 20% as well as needing to obtain private home mortgage insurance coverage. The APR on each car loan changes the promoted rate of interest on the funding to consist of all discount factors, costs, source points, and also any type of other closing prices for the car loan. This metric exists to make comparison less complicated in between fundings with wildly different price cut points, interest rates, and also origination fees. Rates of interest boosts do greater than simply elevate your repayment.

When you understand what bps are used for, it is very easy to see how they can help make sense of financial resources. Bps as well as % interact to offer a much more exact photo of what's happening with rates of interest and various other financial issues that fluctuate in percentages with time. Understanding just how to compare these 2 numbers will aid you to be far better gotten ready for future choices entailing money or investments.

Banks can offer home mortgages without points also because of the "service release costs", which is a http://elliotwvez316.wpsuo.com/what-is-the-disadvantage-to-a-reverse-home-mortgage charge they gain when they sell their financings to other firms on the secondary market. They have to pick a payment package with each lending institution they collaborate with beforehand so all customers are billed the same flat portion price. They are used to purchase down your rate of interest, presuming you desire a reduced rate than what is being used.

- At 90% LTV, the ordinary rate moved up by 7 basis points, providing 4.04%.

- Residence home mortgage factors are tax-deductible completely in the year you pay them, or throughout the duration of your lending.

- At 90% LTV, the ordinary price gained 5 basis factors, finishing the week at 2.55%, as well as, at 80% LTV, the typical rate raised by 9 basis indicate 2.41%.

- The adhering to chart compares the point prices as well as month-to-month payments for a funding without points with loans utilizing factors on a $200,000 home mortgage.

- Don't opt for the first mortgage bundle that you come across.

If the Fed decreases its fed funds target rate, rate of interest on recently provided bonds will certainly decline, and the other way around. Those changes affect the rates financiers want to pay for older bonds, which influences the expected return on the bonds. Price cut points are charges on a home mortgage compensated front to the lending institution, in return for a reduced interest rate over the life of the loan. With the acquisition of three price cut factors, your interest rate would certainly be 2.75%, and also your month-to-month repayment would certainly be $382 each month. On a $100,000 home mortgage with a rates of interest of 3%, your monthly settlement for principal and passion is $421 monthly. The purchase of each factor generally lowers the interest rate on your home loan by approximately 0.25%.

Faster Simpler Less Expensive Digital Mortgages Made Easy

In order to clear up the confusion, if we say that the account pays 5% interest as well as has actually gotten a 500bps increase, you know that you will currently get 10%. If interest rates are at 4.75% and drop to 4.6%, that is a 15-basis point (0.15%) decrease. If a lending price is 5% and increases 20 basis factors, that is the matching of raising the interest rate by 0.2%, or a resulting rate of 5.2%.

Various Other Lendings

If your rate boosts by various other amounts, such as 0.34 percent, it is extra reasonable to state that the price increased by 34 basis factors. The very same selects currency exchange prices as it's always useful to understand whether the rate has altered by 100bps or 0.01%. When a consumer or a mortgage broker "gets down" a home loan rate, they make an in advance settlement to the loan provider in order to reduce the home mortgage rate.

The Federal Book has actually hinted they are likely to taper their bond buying program later this year. If you offer points you wish to have the finance repaid before you reach the break even factor so you are not paying the bank extra passion than you would have if you picked not to purchase points. If the residence customer is rather selling factors, the opposite holds true.

If you are ever before unclear regarding any kind of numbers or percentages on a financing, home mortgage or financial investment, do not authorize anything up until you have sought further advice. Used by home mortgage brokers as well as loan providers when talking about home loan prices and also determining commissions. If your lending's rates of interest rises too expensive, you can purchase a lower rate by paying price cut factors.

This charge needs to be revealed on your Finance Price Quote and also Closing Disclosure. They can be made use of to spend for closing costs on the car loan inclusive of source fees, title fees, assessment costs & recording fees. Adverse points, which are also described as refund points or loan provider credit scores, are the reverse of home mortgage points. As opposed to paying an upfront fee to decrease the rates of interest of the financing, you are paid an upfront cost to be billed a greater rates of interest for the wesley financial group timeshare cancellation cost duration of website the lending.

Ingen kommentarer endnu